Now Reading: The Cost of Studying in the UK: Tuition, Living Expenses & More

-

01

The Cost of Studying in the UK: Tuition, Living Expenses & More

The Cost of Studying in the UK: Tuition, Living Expenses & More

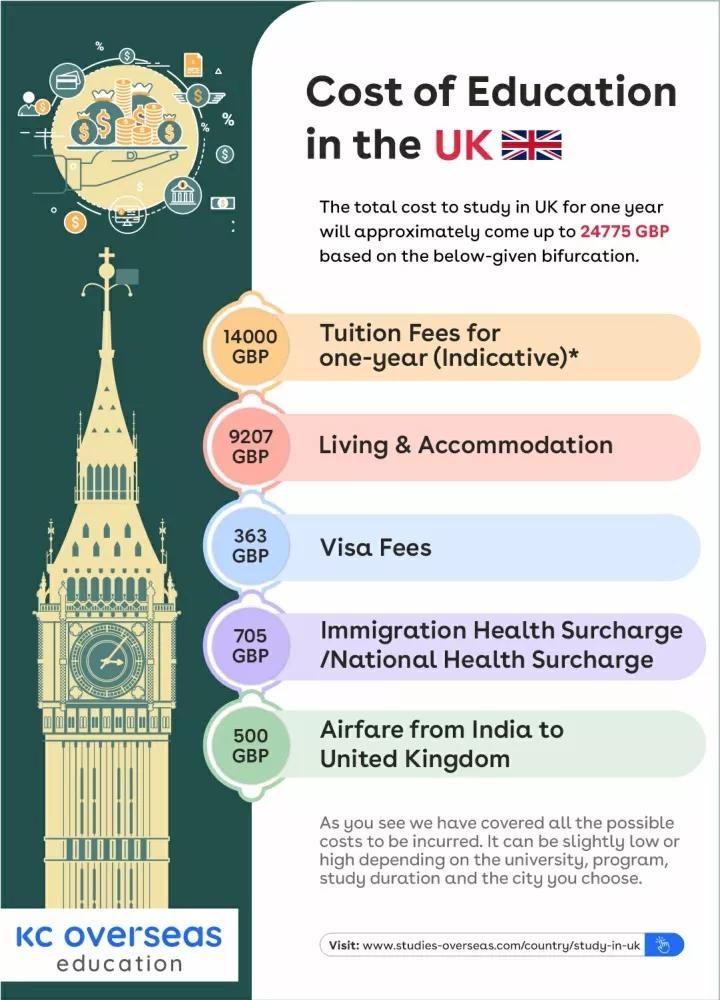

Studying in the United Kingdom has long been a dream for many students around the globe, offering a rich tapestry of history, diverse cultures, adn world-renowned institutions. Yet, as exhilarating as the prospect of immersing oneself in this vibrant academic surroundings can be, it often comes with a hefty price tag.From tuition fees that vary dramatically between institutions and courses,to living expenses that can catch many off-guard,understanding the financial commitment required is essential for prospective students. in this article,we will navigate the multifaceted landscape of costs associated with studying in the UK,examining everything from tuition and accommodation to daily living expenses and hidden fees. Whether you’re an aspiring undergraduate, a postgraduate seeker, or simply curious about the economic implications of education abroad, join us as we uncover the true cost of embarking on an educational journey in one of the most prestigious academic destinations in the world.

Understanding Tuition Fees for international Students

Understanding tuition fees is crucial for international students planning to study in the UK. Tuition fees can vary significantly based on factors such as the university, course of study, and whether the program is undergraduate or postgraduate. On average, international students can expect to pay:

- Undergraduate degrees: £10,000 to £38,000 per year, depending on the field.

- Postgraduate degrees: £11,000 to £40,000 per year, with courses in business or medical fields often at the higher end of the spectrum.

Additionally, many universities may impose additional fees for things like lab equipment, course materials, or student services, wich should also be considered when budgeting. To give you an idea of the range of tuition fees you could encounter, here’s a simplified breakdown of average tuition costs by course type:

| Course Type | Average Tuition Fee (per year) |

|---|---|

| Arts & Humanities | £15,000 - £25,000 |

| engineering & Technology | £20,000 – £30,000 |

| Business & Management | £18,000 - £35,000 |

| medicine & Dentistry | £25,000 – £40,000 |

Navigating Accommodation choices and Living Costs

When it comes to choosing where to live during your studies in the UK, you’ll find a range of options that cater to different budgets and lifestyles. From university halls to private accommodation, it’s essential to consider what best suits your needs. University halls are an excellent choice for first-year students seeking a social environment, as they offer community living with meals included. Alternatively, private rentals can provide greater independence, allowing you to choose your own flatmates and location. Though, with this freedom frequently enough comes a higher price tag, making it crucial to evaluate your financial situation before making a decision.

Living costs can vary significantly based on the city you choose to study in. Major cities like London and Manchester typically have high accommodation fees, while smaller cities or towns may offer more affordable options. Here’s a snapshot of estimated monthly living expenses you might encounter, categorized by city:

| City | Accommodation | Food & Groceries | Transportation</th |

|---|---|---|---|

| London | £1,000+ | £250 | £150 |

| Manchester | £700 | £200 | £100 |

| Edinburgh | £800 | £220 | £80 |

| Birmingham | £650 | £180 | £90 |

Regardless of where you decide to live, it’s vital to create a budget that accounts for all your expenses. From setting aside money for utilities and Internet to indulging in local culture or travel, careful planning will ensure you maximize your experiance without breaking the bank. spend time researching and weighing your options, as the right accommodation can greatly enhance your academic journey in the UK.

Budgeting Tips for Everyday Expenses in the UK

Managing your finances while studying in the UK can feel overwhelming at times, especially with the multitude of everyday expenses you may face. To ensure you’re staying within your means, it’s essential to adhere to a practical budgeting strategy. One effective method is to identify fixed and variable expenses. Fixed expenses include your tuition fees, accommodation, and utilities, while variable expenses encompass groceries, transportation, and entertainment. Keeping track of thes categories can help you better allocate your resources.

Consider utilizing budgeting tools or apps that allow you to monitor your spending habits. In addition, creating a monthly budget with a clear breakdown of your income against expenses can keep you organized. you should also explore cost-saving options such as:

- student discounts: Always carry your student ID for discounts on transport, groceries, and dining.

- Shared accommodation: Look for flatmates to split housing costs.

- Public transport: Use buses or trains rather of taxis for significant savings.

- Meal prep: Cook in batches to reduce food wastage and save money.

For a clearer picture of potential living costs, consider the following table summarizing average expenses:

| Expense Category | Average Monthly Cost (£) |

|---|---|

| Tuition Fees | £9,250 |

| Accommodation | £600 |

| Groceries | £200 |

| Transport | £60 |

| Entertainment | £100 |

Financial Aid and Scholarships to Alleviate Costs

for international students considering an education in the UK, understanding financial aid options and scholarships can significantly reduce the financial burden. Various institutions offer scholarships tailored to different needs, rewarding academic excellence, cultural diversity, and specialized fields. Here are some opportunities to explore:

- University Scholarships: Many universities provide their own scholarship programs for both domestic and international students, often based on merit or specific criteria.

- Government Grants: The UK government offers funding options such as the Chevening Scholarships and the Commonwealth Scholarships for postgraduate students.

- private Organizations: Numerous private foundations and corporations also sponsor scholarships in the UK, aimed at promoting education and skills advancement.

In addition to scholarships, various financial aid options can support students throughout their studies. Many institutions provide flexible payment plans, allowing students to manage their tuition fees more effectively. Additionally, local councils offer support for living expenses, particularly for those in financial need. Below is a simplified overview of potential financial aid sources:

| Source | Type | Eligibility |

|---|---|---|

| University Scholarships | Merit-based | Varies by institution |

| Chevening Scholarships | Government | Postgraduate students |

| private Foundation grants | Need-based | Depending on the institution |

The Conclusion

embarking on an educational journey in the UK is a decision that resonates with countless students worldwide, drawn by the allure of prestigious universities and a rich cultural tapestry. However, this path is accompanied by a financial commitment that deserves careful consideration.

From tuition fees that can vary significantly across disciplines to living expenses that ebb and flow with the dynamic nature of city life, understanding the complete financial landscape is crucial. Beyond academics, immersing oneself in the local culture, seizing opportunities for personal growth, and exploring breathtaking vistas come with their own costs and rewards.

Ultimately,weighing the investment against potential returns—academic,professional,and experiential—can help illuminate the true value of studying in this historically rich and diverse nation. As you reflect on the numbers, remember that education is not just about the dollars spent but the myriad experiences, relationships, and skills gained along the way.In navigating the complexities of finances, may you find clarity and confidence in your pursuit of knowledge in the UK. Safe travels and best of luck on your academic adventure!