By Sara Guaglione • December 13, 2024 •

Ivy Liu

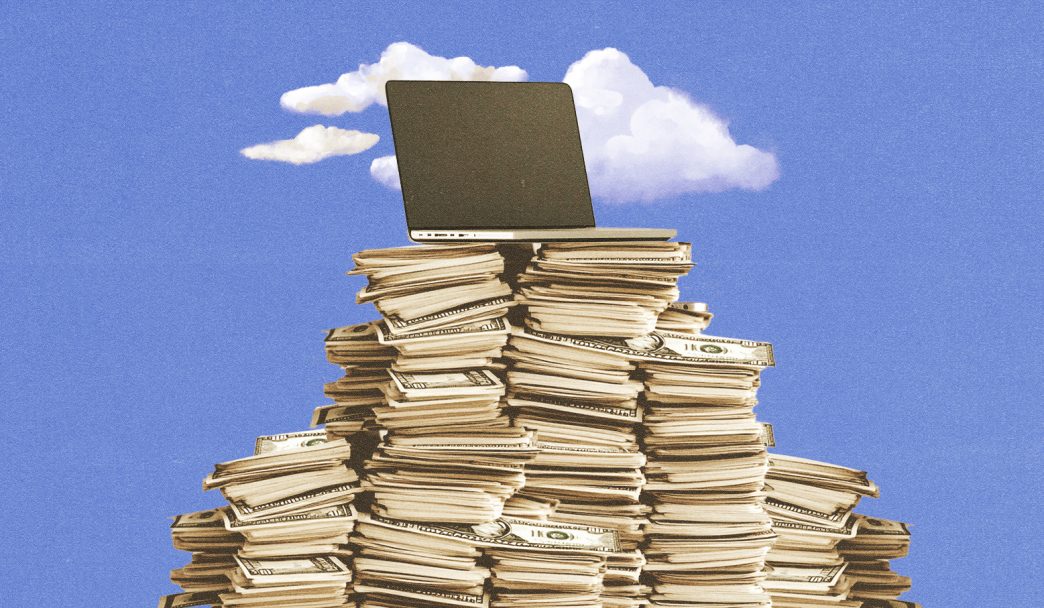

After selling First We Feast following the sale of Complex earlier this year, BuzzFeed has come close to breaking even on its 2021 acquisition of Complex Networks. Investor analysts are describing the deal as a good sign for the media M&A market — which itself is an indication of how ugly that market had become.

A group of investors will pay BuzzFeed $82.5 million for First We Feast, which includes the popular “Hot Ones” franchise. Add to that the $108.6 million plus $5.7 million in fees BuzzFeed is getting from February’s sale of Complex to NTWRK, and BuzzFeed will have made back $196.8 million of the $198 million it originally paid for Complex Networks in 2021.

BuzzFeed is still effectively taking a loss on the overall Complex acquisition, but First We Feast’s $82.5 million price tag indicates an improving media M&A market. Bloomberg reported in June that BuzzFeed was struggling to find a buyer for First We Feast with a $70 million sale price.

“It’s a good sign that [BuzzFeed] was able to get what they paid for [Complex and First We Feast],” said Sam Thompson, senior managing director at M&A advisory firm Progress Partners. While ideally the company would have grown the audience and revenue for those businesses and gotten more than what they paid for, he said the sale coincides with a “swing back” he’s seen this year toward a better climate for M&A activity. “More deals are coming back up” after a “media recession” last year, Thompson added.

“Given the pressure of their financial situation, this specific sale sounds like a good survival move and positions the main platform to live for another day,” Doug Arthur, managing director at media research and advisory firm Huber Research Partners, said in an email. “Getting out of assets for around the price they bought them is better than the alternative and interesting that there are still willing buyers at reasonable prices for these assets.”

The sale also means BuzzFeed will now be operating with a cash balance that is larger than its total outstanding debt, according to a spokesperson.

BuzzFeed was on the hook for more than $120 million of debt and interest payments, and creditors could ask for their money back after a Dec. 3, 2024 deadline. However, Thompson and Arthur told Digiday that bond holders would likely wait for the company to announce a strategic plan or restructuring before they did so.

That plan has materialized. The sale of First We Feast reduces the company’s outstanding debt by $88.8 million, now totalling $30 million, according to a spokesperson. BuzzFeed says it removed more than $150 million of debt over the past year. The spokesperson said the company now has until December 2026 to pay back its debt.

While that means BuzzFeed does “have time” to pay that debt, $30 million “is not going to come through cash flows,” Thompson said. He speculated that BuzzFeed may be looking at selling even more assets, such as HuffPost. A BuzzFeed spokesperson denied the speculation that HuffPost could be up for sale.

In a statement, BuzzFeed said the sale means the company has completed its “strategic shift away from lower-margin content products, allowing for a greater focus on high-margin, tech-enabled revenue lines: programmatic advertising and affiliate commerce.”

BuzzFeed founder and CEO Jonah Peretti stated that the company can now “fully benefit from the ongoing AI revolution” and launch “new AI-powered interactive experiences” — a vision for the company he’s been touting for over a year.

The market didn’t respond all that favorably to news of the sale. BuzzFeed’s stock price fell 20% on Thursday, to $3.57 per share.

The buyers of First We Feast are a consortium of investors led by founder Chris Schonberger and “Hot Ones” host Sean Evans, alongside Crooked Media, Mythical Entertainment and Soros Fund Management, among other investors, according to a statement.

BuzzFeed also released guidance for its fourth quarter performance on Thursday. Excluding expected contributions from First We Feast, the guidance for Q4 is:

- Revenues are expected to be in the range of $54 million to $58 million. (Last year’s Q4 revenue was $75.7 million)

- Adjusted EBITDA is now expected to be in the range of $4 million to $9 million. (Last year’s Q4 adjusted EBITDA was $15.1 million)

Matt Omer, CFO of BuzzFeed, said the company is expecting growth in programmatic advertising and affiliate commerce revenue in 2024 year over year.

Editor’s note: This story has been updated to reflect BuzzFeed’s position on a potential HuffPost sale.

https://digiday.com/?p=563251